how to avoid estate tax in california

Property transfer taxes are derived from the selling price of your home. Neither lifetime gifts nor bequests in.

Estate Tax Definition Who Pays

There are a few ways individuals can protect their beneficiaries from inheritance tax.

. But you still could get caught in the federal estate tax. What Are the Legal Options to Avoid Estate Tax in California. The California Revenue and Taxation Code states that all the counties in California have to pay.

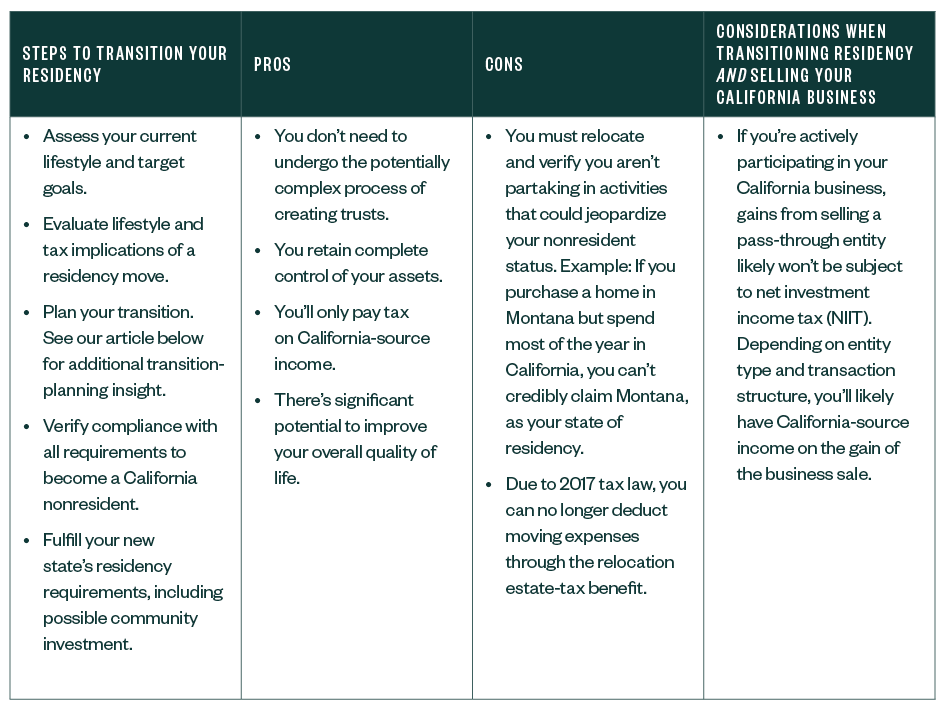

California property tax planning and more specifically avoiding reassessment of property taxes has never been more important. Since California does not impose an estate tax you dont have to worry much. How can I avoid paying property taxes in Texas.

In order to come up with the right strategies on how to avoid paying California state income tax you might need to work with a team of experts such as a tax accountant a financial. The federal estate tax goes into effect for estates valued at 117 million and up in 2021 for singles. Your heirs pay the estate tax on the balance of your estate.

Instead of gifting money to get it out of your estate you could. The best way to avoid capital gains tax on the sale of your California residential real estate is to take full advantage of the exemption. The typical Texas homeowner pays 3390 annually in property taxes.

If you are going to receive an inheritance from someone who lived in a state other than California talk with your fiduciary financial planner to check the estate tax laws affecting. California estates must follow the federal estate tax which taxes certain large estates. The easiest but most commonly overlooked action is the filing of a Prop.

How to Legally Avoid the California Estate Tax. In California a single taxpayer can save up to 250000. Inheritance tax is money paid by the person who received or inherited the money after it has already been dispersed.

Learn How To Reduce Property Tax in California With DoNotPay. Consider the alternate valuation date. Apply for permanent life insurance.

In some cases an executor might just have a different alternate. The surest way to avoid or. How to Avoid California Property Tax Reassessment.

How to avoid the New York estate tax cliff Outlining in your will or revocable trust exactly how your assets should be handled makes your estate executors job much easier. There are ten common methods to reduce estate taxes when you die and often reduce your tax returns today. Blessed is the hand that gives indeed.

The estate tax exemption is a whopping 234 million per couple in 2021. The gift tax exemption threshold is 15000 in 2021. So if you have an 18 million estate you can gradually pass on your assets to your loved ones until the net value of your estate is less than or equal to 1206 million.

How To Avoid Estate Tax With Life Insurance. California residents dont need to worry about a state inheritance or estate tax as its 0. Estate tax should not be confused with inheritance tax.

Marin County collects the highest property tax in. If your estate will be subject to capital gains after your death you can use permanent life insurance to pay those taxes. 8 appeal by 915 of each tax year.

Living the easy life in California is a dream for many but it comes at a priceproperty prices are the second. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year.

California Estate Tax Everything You Need To Know Smartasset

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

How Could We Reform The Estate Tax Tax Policy Center

How Does Prop 19 Affect My Estate Loew Law Group

How To Avoid Estate Tax For Ultra High Net Worth Family

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Estate Tax Current Law 2026 Biden Tax Proposal

States With No Estate Tax Or Inheritance Tax Plan Where You Die

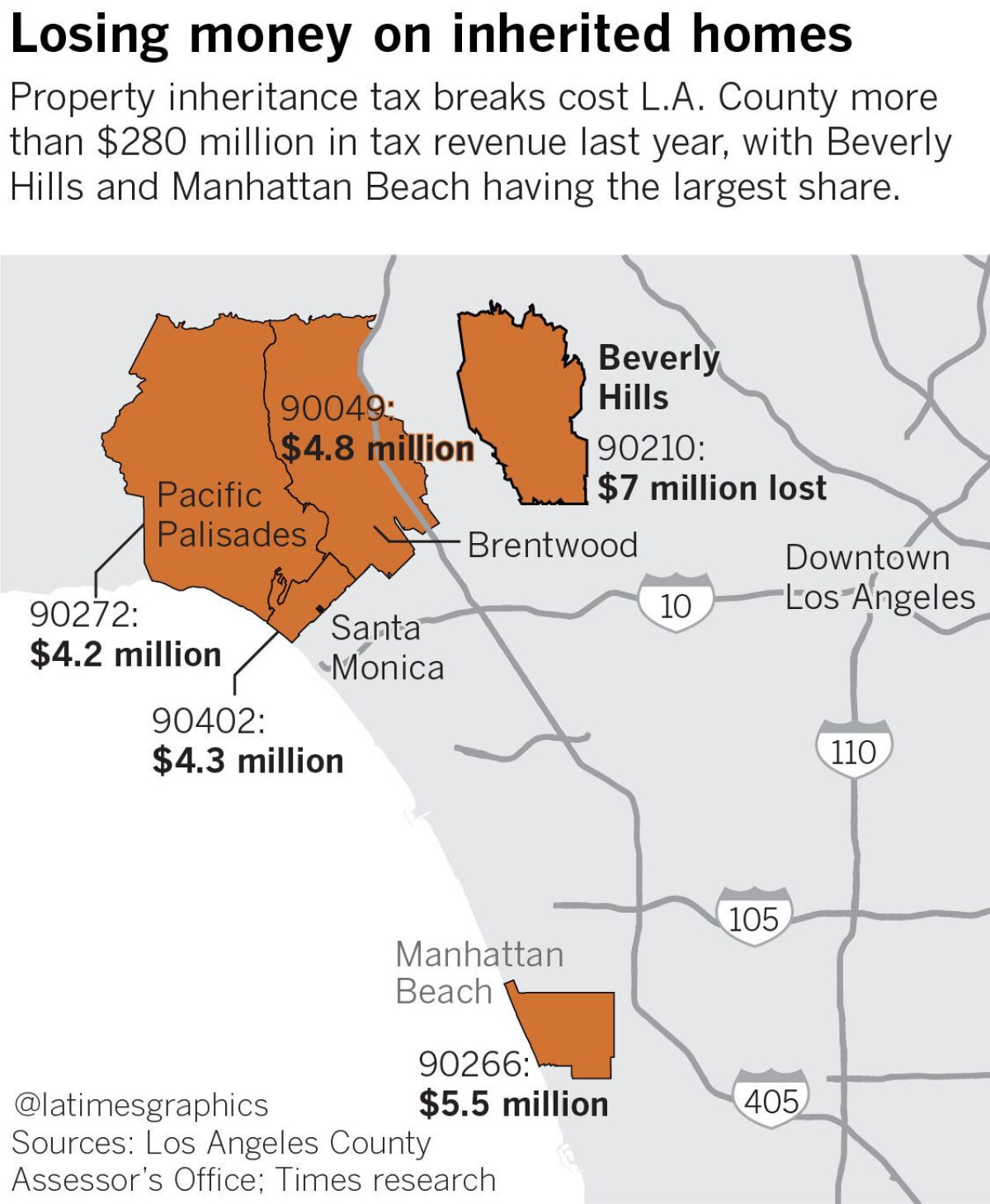

The Property Tax Inheritance Exclusion

What Is An Estate Tax Napkin Finance

Wills Trusts Probate Nevada And California

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Inheritance Tax Here S Who Pays And In Which States Bankrate

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Transferring Real Property How To Avoid An Unexpected Tax Hike In California Aspiriant

The Estate Planning Safety Valve California Disclaimer Trusts California Trust Estate Probate Litigation

Navigating New California Proposition 19 Its Dramatic Property Tax Increase On Inherited Property And Added Benefits To Portability For Those 55 And Older Lucas Real Estate

California Homeowners Get To Pass Low Property Taxes To Their Kids It S Proved Highly Profitable To An Elite Group Los Angeles Times